BRICS, Explained

Multipolarity, Currency and Energy

January 18, 2026

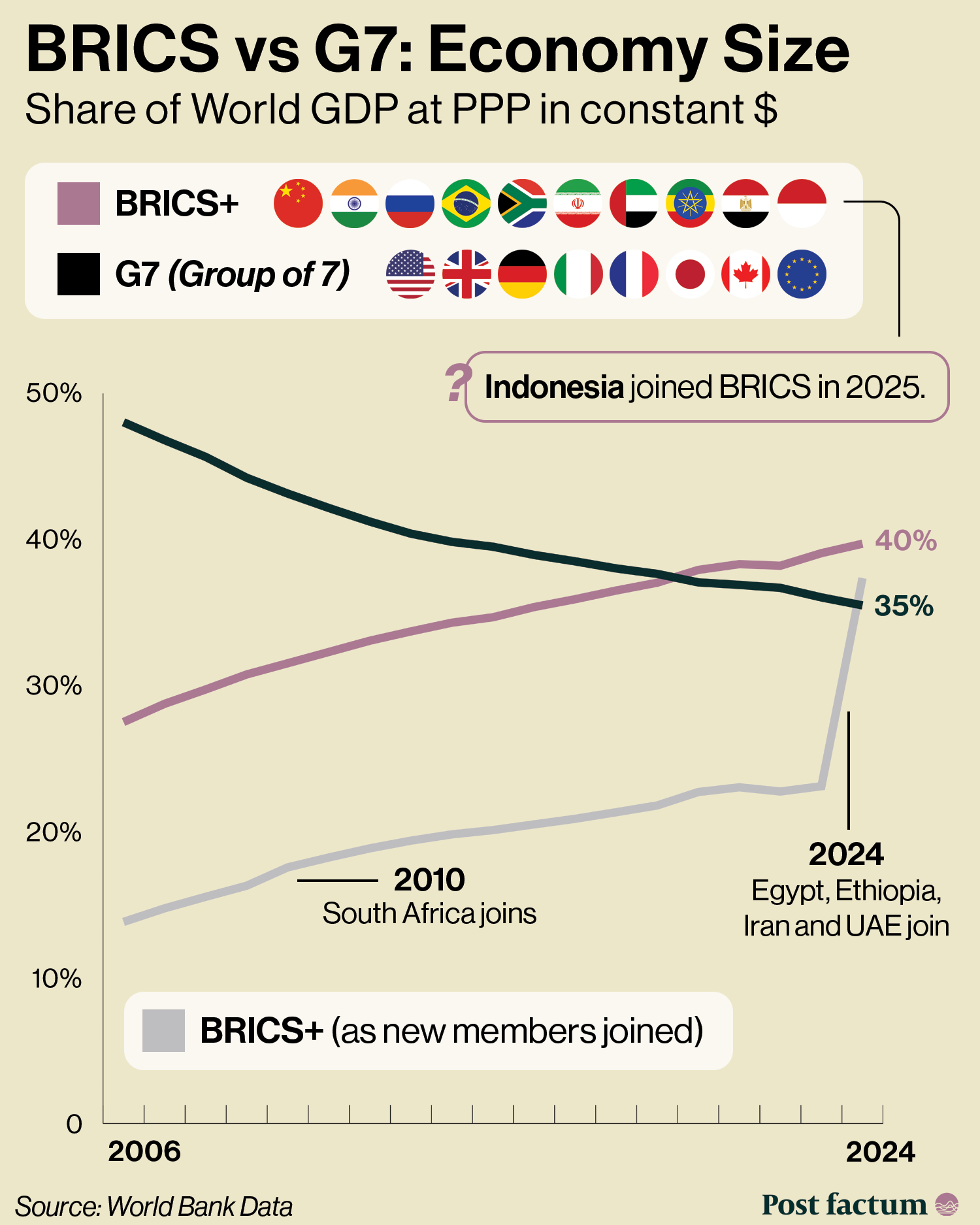

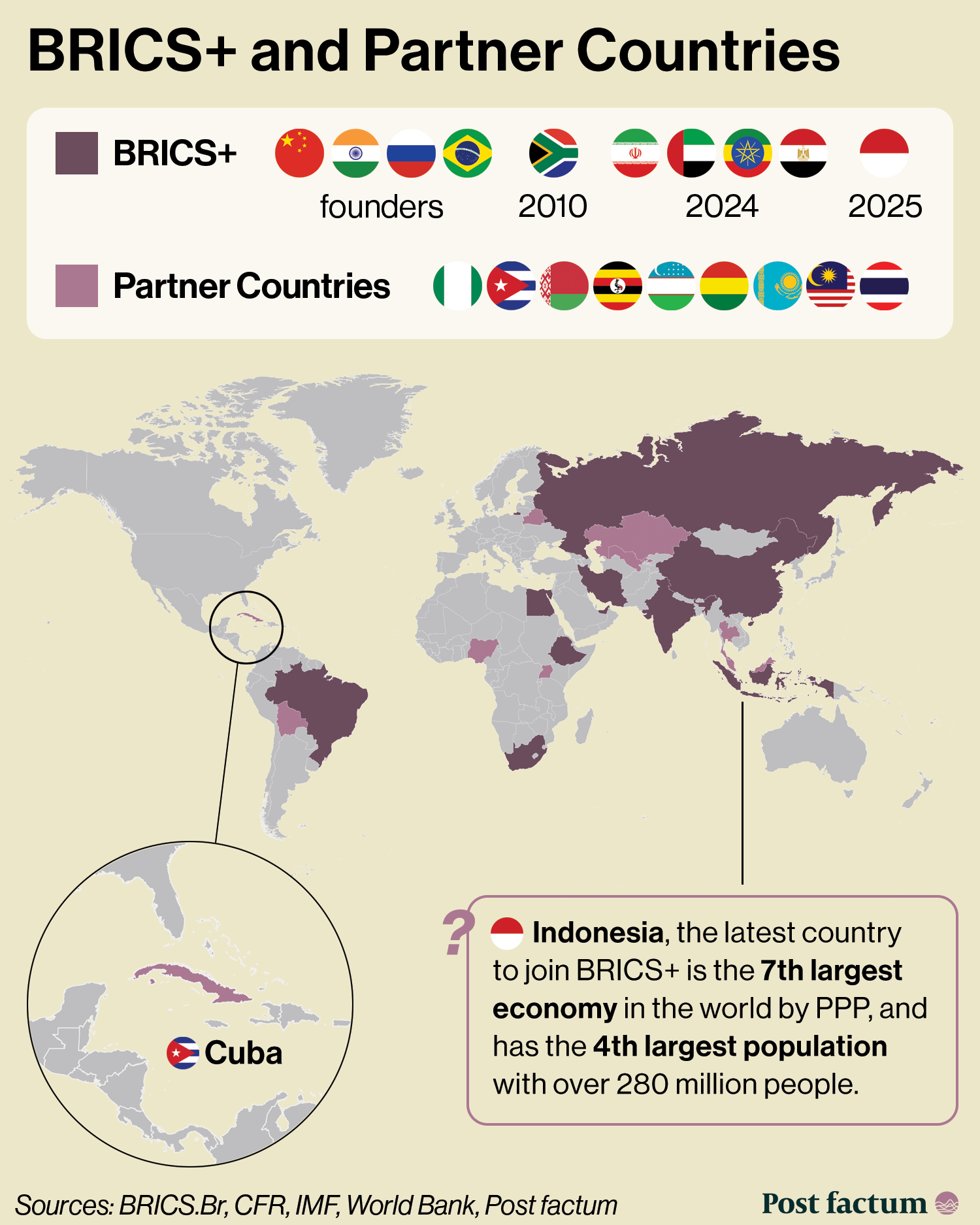

BRICS is an international organisation formed by Brazil, Russia, India and China in 2009. South Africa joined in 2010.

It expanded into BRICS+ when Egypt, Ethiopia, the United Arab Emirates and Iran joined in 2024.

In 2025, Indonesia also joined BRICS+.

BRICS pushes for multipolarity: reducing US geopolitical influence in favour of emerging powers.

This is partly by reducing the role of dollar as the main international currency.

However, BRICS members sometimes have conflicting national interests and foreign policies.

India and China have an unresolved border dispute with recurring military clashes.

China and Russia are permanent members of the United Nations Security Council, giving BRICS veto powers.

BRICS+ accounts for a half of the world's population, and 40% of the world's GDP at purchasing power parity, outperforming the combined G7.

BRICS established alternatives to the World Bank and IMF:

The New Development Bank for infrastructure financing.

The Contingent Reserve Arrangement for economic support during crises.

There are no BRICS membership requirements except approval by all existing members.

Saudi Arabia was invited and had plans to join but currently only takes part as an invited state.

Saudi Arabia balances its ties with China, its biggest oil customer, and the US, its security and technology partner.

Argentina was invited but declined to join after President Milei's 2023 election, choosing to strengthen ties with the US.

BRICS has 9 partner members: Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda and Uzbekistan.

BRICS includes both:

Fossil fuel economies: countries like Iran and Russia rely on crude oil or gas exports, and produce most of their own energy from them.

“Electrostates”: countries prioritising renewable or clean energy sources, electric vehicles, and green tech.

China generated 18% of its electricity from solar and wind power in 2024, up from 9% in 2020.

Around 70% of wind and solar power projects currently under construction are in China.

Brazil is the world's second-largest biofuel producer, accounting for about 20% of global output.

Biofuel is a renewable energy source that derives from plant, seaweed or animal biomass.

BRICS dominates global production and reserves of metals critical to the green transition.

BRICS holds 74% of global rare earths reserves.

In 2024, BRICS members accounted for 30.5% of global oil production and 32% of global oil consumption.

Russia and Iran's oil exports are under Western sanctions, but other BRICS members continue to import their oil.

China buys around 90% of Iran's oil exports.

China and India buy about 85% of Russia's oil exports.

International payments for oil are most often made in US dollars.

BRICS members push for the use of alternative currencies and payment methods, in the oil industry and beyond.

In 2023, about 20% of global oil trade was settled in non-dollar currencies, especially Indian rupees, and Chinese renminbi (yuan).

Russia and China conduct most of the trade between them in local currencies.

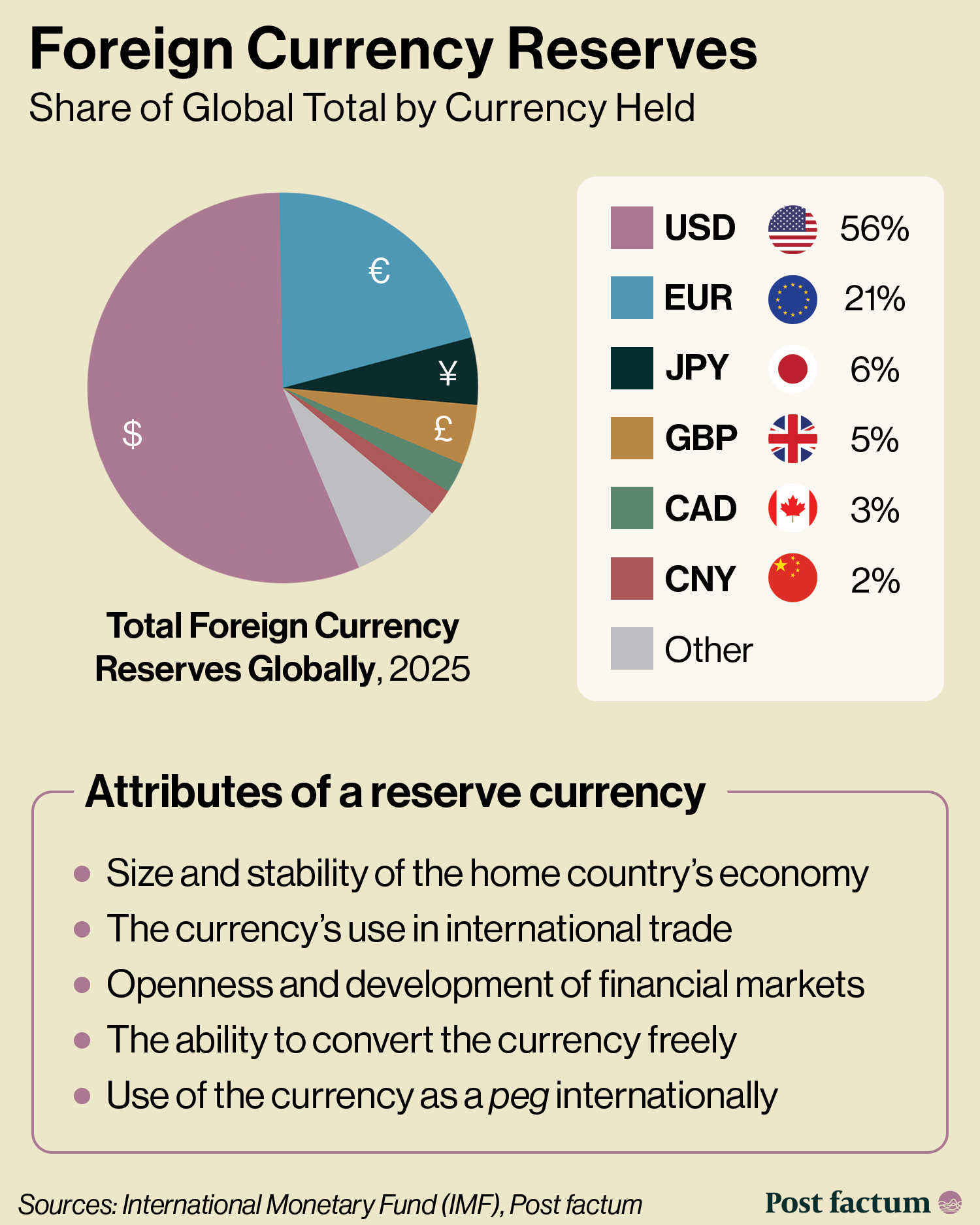

The US dollar is the leading currency for global reserves and trade.

However, the US dollar's share of global currency reserves fell from 71% in 2000 to 56% in 2025.

China's yuan accounted for about 2% of global reserves in 2025.

Why? China restricts how money moves in and out of the country, limits currency exchange, and does not have independent financial markets.

BRICS members have discussed creating a common currency similar to the euro.

However, this is not a short-term possibility because of (1) the differences and incompatibilities between member economies, and (2) US-led political pressure.

In 2024, President Trump threatened to apply 100% tariffs on the BRICS members pursuing de-dollarisation.

In response, Indonesia, Brazil, India and Russia publicly stated that they were not interested in establishing a BRICS currency.

The US dollar is used for 48% of international SWIFT payments, compared to 4.5% for the yuan.

SWIFT is a messaging system that handles most of international transactions: $150 trillion per year.

Cutting access to SWIFT was part of the sanctions against countries like Russia.

BRICS members have national payment systems used mostly locally.

China's payments system is the most internationally developed. It processed $24.5 trillion in international payments in 2024.

BRICS members are developing BRICS Pay, a shared cross-border platform linking their national payment systems.

BRICS members have been interested in gold as a reserve asset because it is harder to sanction and tends to keep value during crises.

Since 2020, BRICS members have doubled gold's share of their reserves.

BRICS has no free trade agreement, a deal that removes tariffs between signatory countries.

Tariffs among BRICS members average 8.4%, compared with 1.1% among OECD members, excluding the US.

The OECD is an international organisation of 38 democracies with advanced free market economies.

Author Elia Preto Martini

Editor Anton Kutuzov

Join Post factum Pro to access the comments section