Geopolitics of Microchips

October 5, 2025

In this report, we analyse Taiwan’s Silicon Shield and explain the complex global supply chain of microchips.

An integrated circuit, also known as a chip, a microchip or a semiconductor, is a small thin piece of silicon (wafer) with a chain of tiny electronics on it.

Microchips are needed for most modern devices: from smartphones and refrigerators to medical equipment and precision missiles.

Chips process, control and store data, allowing for miniature-sized gadgets.

Why are chips geopolitically important?

A secured supply of advanced chips is needed to produce modern military equipment and other high-tech devices.

Access to chips that are comparatively better than rivals’ can give a technological advantage in many industries.

How are chips improved?

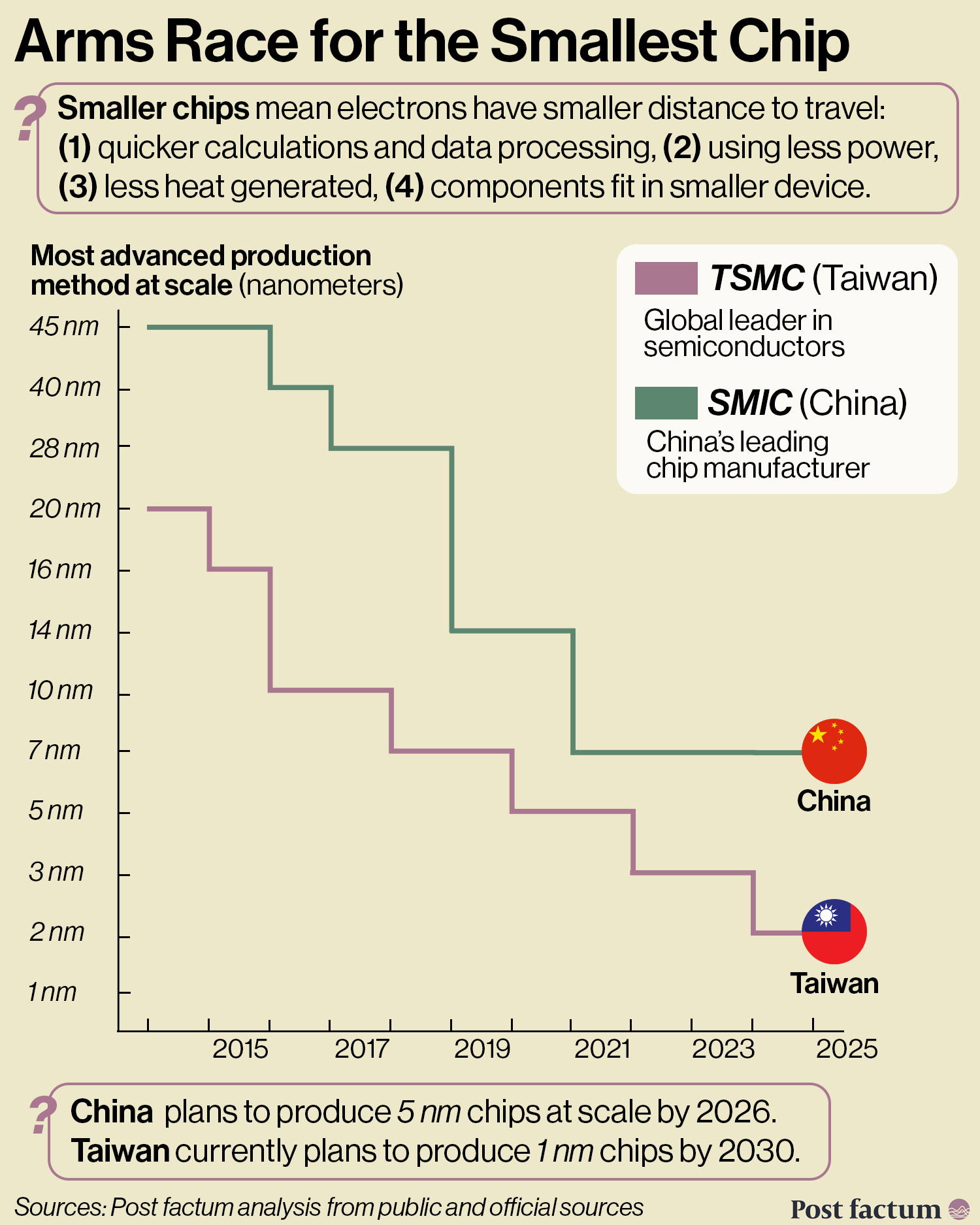

Scientists and engineers design better manufacturing methods that allow to put more transistors on a chip.

This means that electrons travel a shorter distance, making the devices smaller and more effective.

Between 1956 and 2015, microchips became a trillion times more powerful (at making calculations), driving the technological advancements of this period.

In 2024, $630 billion microchips were sold globally: that is 140 chips for every person on earth, every year.

Global chip sales are expected to grow by another 50% by 2030.

Chips' Global Supply Chain

There is no country that can fully design and manufacture a chip independently.

Manufacturing a chip can take up to 6 months and the components can cross international borders over 70 times before reaching consumers.

Chips’ global supply chain has multiple phases, often dominated by one or a few firms.

Private firms, governmental labs and universities research new materials and manufacturing processes.

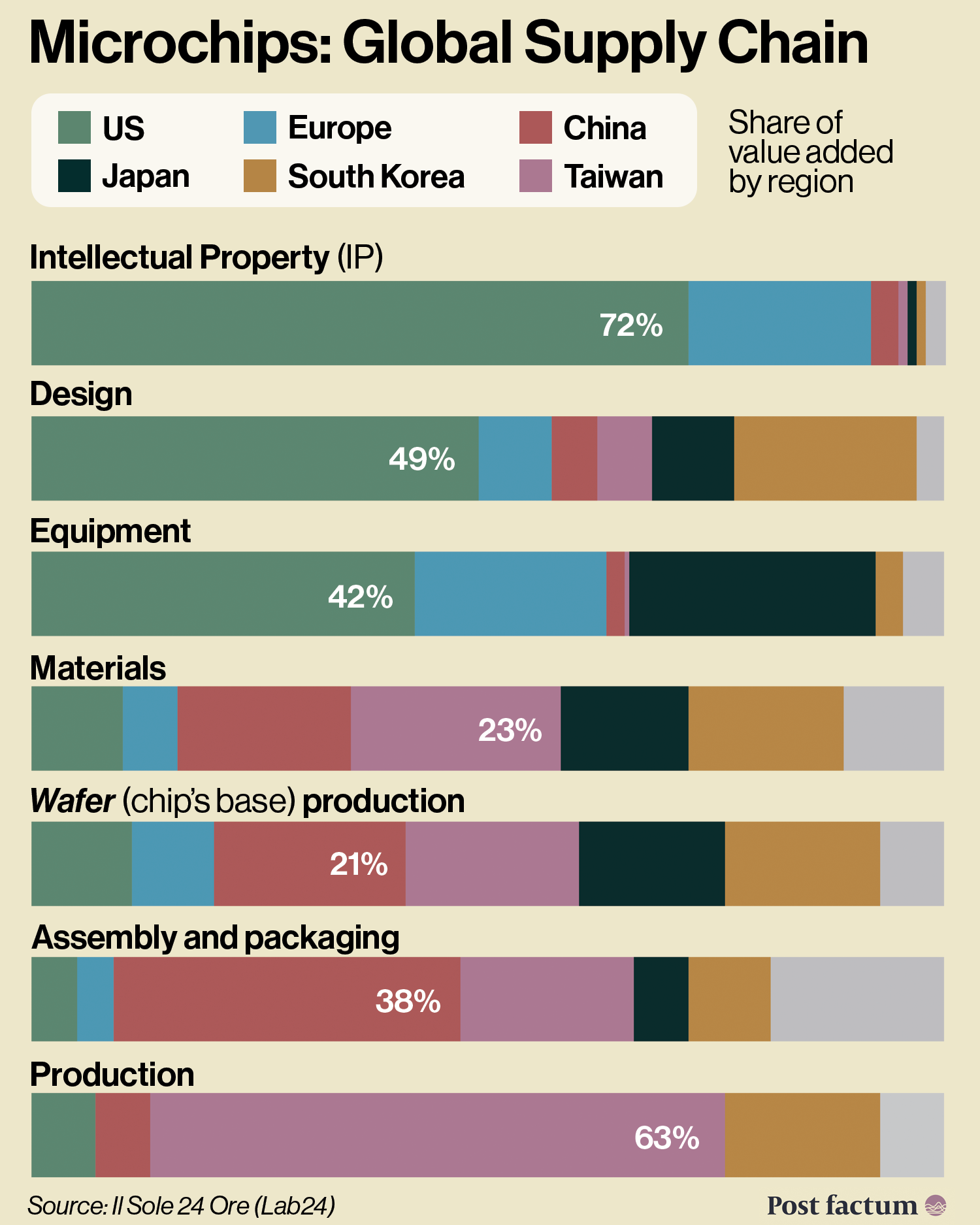

The US contributes 72% of the value added to the chips industry at the intellectual property (IP) stage.

US-based Intel and NVIDIA are the leading private firms in research and development (R&D).

The US also has the biggest share in design (49%) and equipment (42%).

Europe and Japan are major players in the equipment market, producing advanced chipmaking tools.

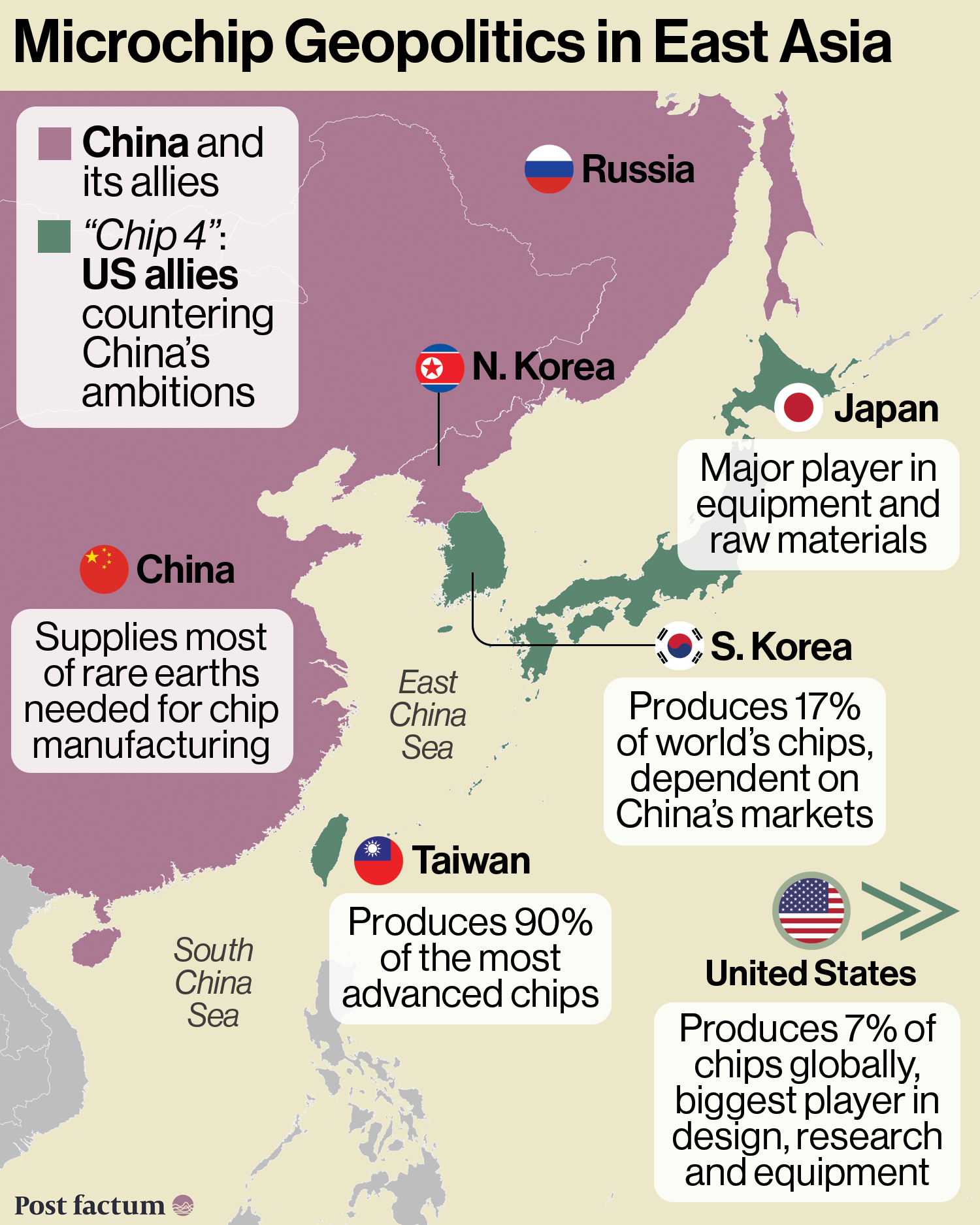

Taiwan dominates chips production, especially in advanced (60%) and most advanced (90%) chips.

China is the largest producer of basic microchips, while US is the largest producer of mid-range chips.

Specific chips are designed to optimise power, cost and performance based on specific use.

For example, Germany is not a major international chipmaker but produces specialised chips, such as for cars.

China controls most of the supply of rare earths needed to produce microchips.

Export controls: In 2018, the US started restricting the sale of chip tools, design software and intellectual property to China.

Result: China's production of advanced chips slowed.

Meaning: chokepoints at the design stage can be as powerful as those in manufacturing.

TSMC (Taiwan) and Samsung (S. Korea) produce nearly all most advanced microchips.

They use lithography machines (they print electronic circuits onto silicon chips) which are produced exclusively by the firm ASML (Netherlands).

In 2025, the Netherlands, pressured by the US, restricted ASML from selling its newest machines to China.

Geopolitics: Taiwan

The microchip industry is part of the China-US rivalry, especially as China has plans to potentially invade Taiwan.

Neither China nor the US is close to achieving self-sufficiency in the chip industry.

Both countries restricted exports in areas where they hold an advantage to slow the other's progress.

In 2022, the Biden administration banned the sale of some advanced chips used in AI training to China.

In 2025, the Trump administration reversed the policy, allowing the sale of those chips to China for a 15% revenue share.

Why? The US wants to keep its chips as the global standard, while boosting its companies' revenues in China.

Taiwan manufactures 60% of the world’s chips, including 92% of the most advanced ones.

Chinese President Xi Jinping has declared the goal of unifying China and Taiwan, potentially with the use of force.

Taiwan’s chip industry is called its Silicon Shield:

The disruption to the chips' global supply chain would cause trillions of dollars of damages, motivating the US and other countries to defend Taiwan.

A Chinese blockade of Taiwan could cost the world economy $2.7 trillion, while costs of a full-scale war would be above $10 trillion.

For comparison, the global cost of the Russia-Ukraine conflict is estimated at $250-500 billion so far.

Control of Taiwan’s chip industry would give China dominance in advanced chips and reshape the global economic and military balance of power.

Geopolitics: self-sufficiency

In 2021, India invested about $20 billion to support local chip industry. India imported 95% of its chips that year.

In 2023, the EU adopted a $50 billion plan to boost chip R&D and manufacturing, aiming to double its global chip market share to 20% by 2030.

In 2024, Japan pledged $4.9 billion in subsidies for TSMC to build a new foundry (also fab or factory) and announced a $65 billion plan to advance its microchip and AI industries.

In 2024, South Korea announced a $470 billion project with domestic chipmakers to build a production megacluster, including foundries and R&D centres, by 2047.

In 2022, the US proposed the Chip 4, an informal alliance with Japan, South Korea and Taiwan aimed at countering China’s ambitions in the chips sector.

South Korea has to balance its Chip 4 participation with its integration into China’s chip ecosystem:

It exports a third of its chips to China, imports nearly half of its rare earth elements from China, and operates factories there.

South Korean chip fabs in China must get yearly approval from the US to use its equipment and materials.

Why? To keep South Korean fabs operational while preventing China's access to advanced chips.

China has expanded chip trade with Russia following Western sanctions imposed after the Ukraine invasion.

Russia has a significant number of chip foundries but only produces basic chips for local use.

In 2023, Russia imported 89% of its chips and nearly half of its chip manufacturing equipment from China.

Author Elia Preto Martini

Editor Anton Kutuzov

More below:

Join the discussion: