Dollar’s global dominance

Currency Geopolitics, explained

June 8, 2025

Throughout history, trade was carried out using precious metals or by directly exchanging goods.

Gold and silver were popular for storing commonly accepted value compactly.

Paper money became preferred due to its light weight but its value was linked to gold.

Gold standard: a system where the value of paper money in a country is equal to the gold reserves it holds.

Having a gold-backed currency provides stability and can help combat inflation by preventing excessive printing of money.

However, it also reduces a government’s ability to respond to crises.

Over the 20th century, governments began moving away from the gold standard.

Today, all currencies are fiat currencies, meaning they are not backed by a commodity like gold, but instead have value that reflects supply, demand, government policies and market confidence.

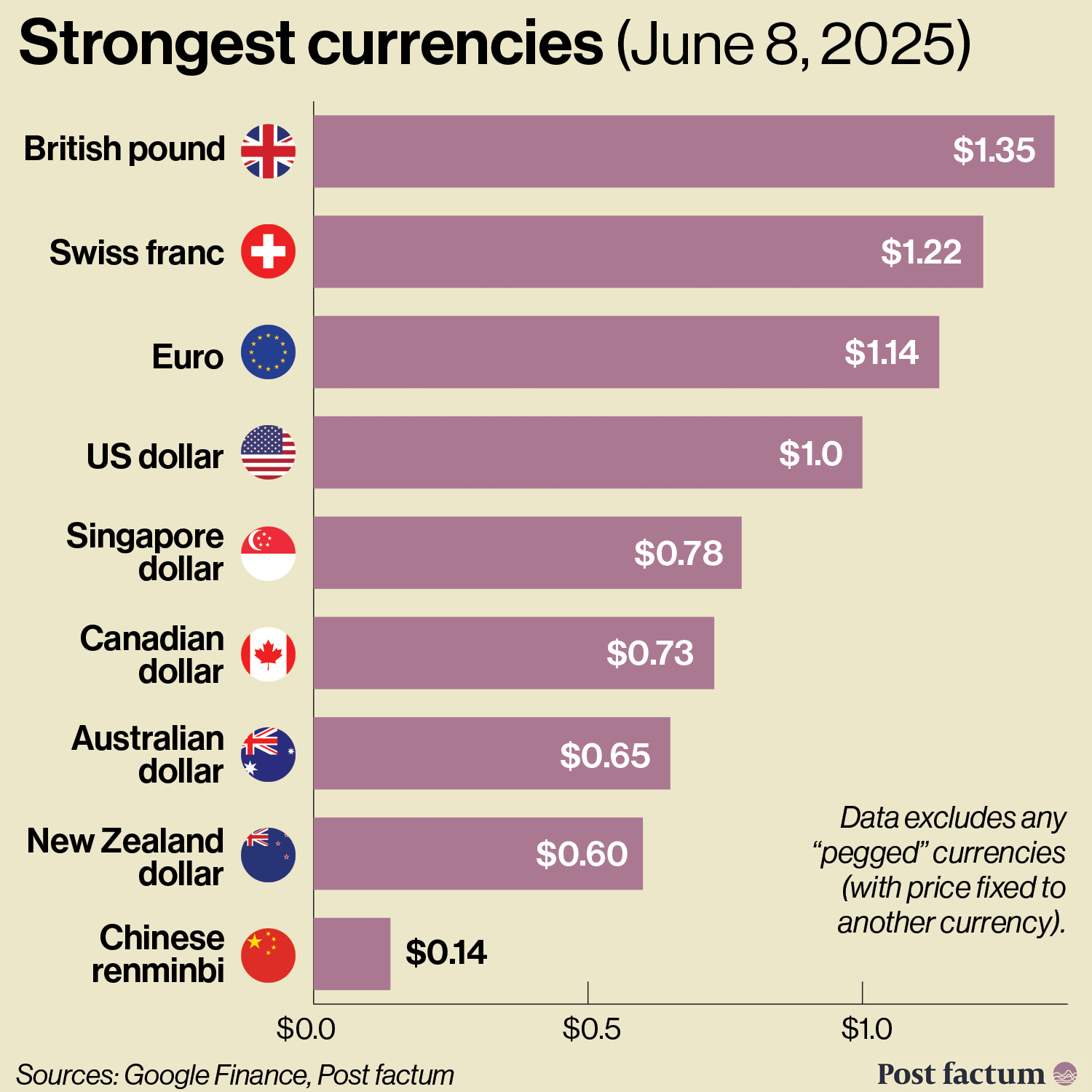

All governments can issue their own currencies, but not all are viewed equally.

Demand for the exports of the country and desire to invest in it increases the price of the currency, as more people buy it. This is boosted by the confidence in the stability of the country.

A strong currency is generally beneficial to importers, who are able to buy more foreign goods for the same amount of money.

A weak currency benefits exporters since their goods become cheaper for their foreign customers.

Since no country is either just an importer or an exporter, the effects of changing exchange rates can be complex.

Governments can make currency interventions: using reserves of foreign currency to buy their own, increasing its value, or the opposite.

This is normally done to influence the exchange rate, but sometimes to protect the economy from crises.

The US monitors currency policies of other countries and decides if they are using “unfair practices” to manipulate their currency. There are numerical criteria for this assessment.

Being named a “currency manipulator” results in economic sanctions and is often a political move.

Dollar Hegemony

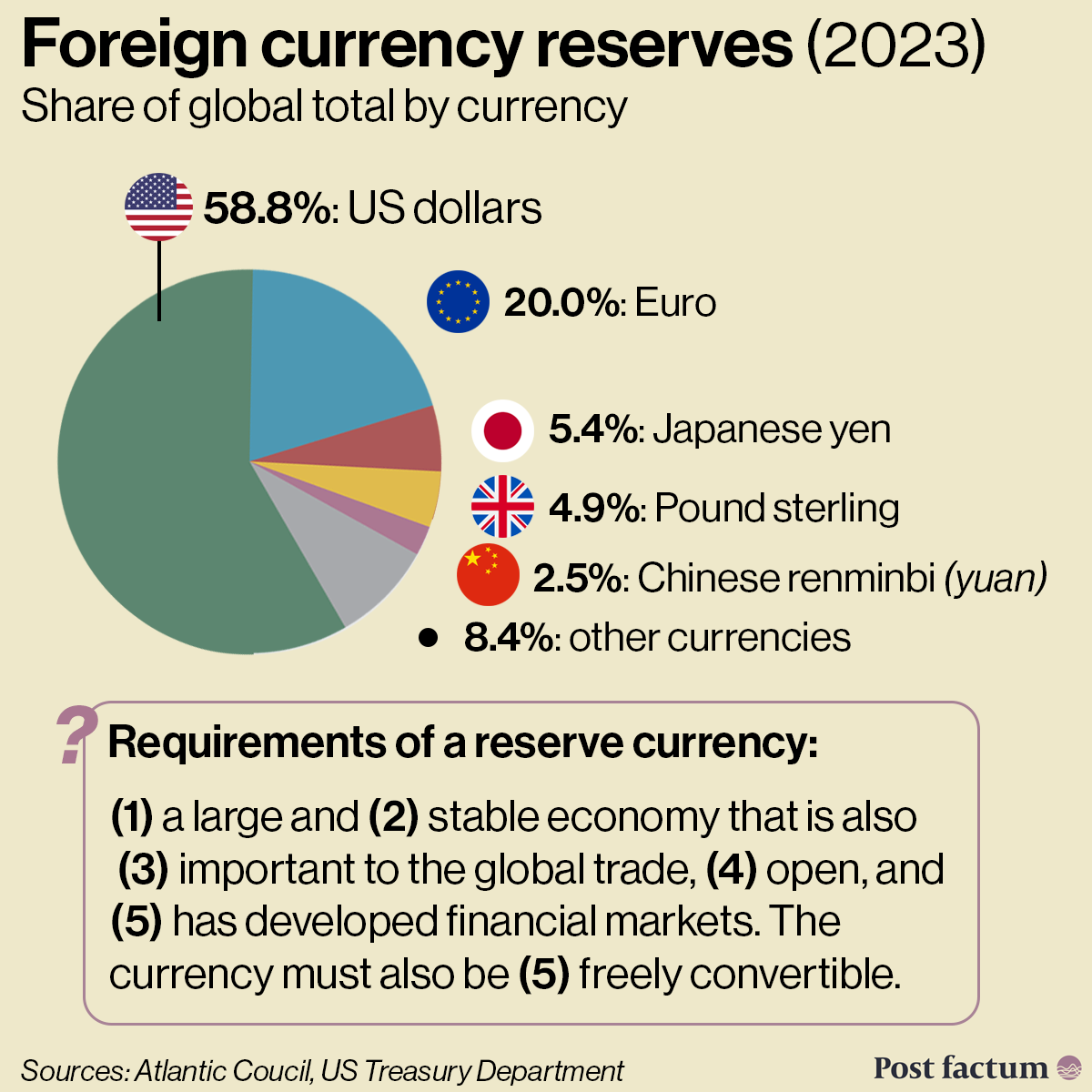

The world’s most powerful currency is the US dollar due to its widespread use, especially in foreign currency transactions.

Foreign exchange has a daily turnover of over $7.5 trillion, with most of transactions made between banks.

Dollar’s strength comes from (1) the strength of the US economy and (2) the global economic order coming out of the Second World War.

After 1945, the US provided loans to help rebuild European countries, as well as exporting industrial goods and equipment. This strengthened the global centrality of the dollar.

The US is a leading country in institutions like the International Monetary Fund and the World Bank that control global lending.

The US has a 16.5% voting power in the IMF, and a 15.8% share in the World Bank. Japan is the second strongest voter with 6% and 7% respectively, China closely follows.

Most global energy trade is carried out in US dollars, which has led to revenue generated by oil exporters being nicknamed “petrodollars.”

Since the 1970s the United States has had a trade deficit, meaning it imports more than it exports.

One result of this has been that dollars have been leaving the US and increasingly circulating in the global economy, making the US dollar more central to international trade.

The strength and stability of the US dollar has led several countries to peg their currency to the US dollar, meaning their exchange rate is fixed.

Weaponisation of Currencies

As global interconnectedness increased, currencies have become tools of geopolitical competition.

Governments, especially in the West have used various economic tools to change the behaviour of foreign states or weaken rivals.

Sanctions: Forbidding economic relations with targeted individuals, organisations or governments.

Example: Countries like Iran and North Korea are unable to trade freely as a result of a sanctions regime, which limits their economic activity.

Freezing assets: Denying access to money belonging to foreign governments.

Example: Following the Taliban takeover of Afghanistan in 2021, the US froze Afghan central bank assets held in the US in order to prevent the money from being used by the Taliban.

Financial exclusion: Preventing the use of financial instruments and institutions.

Example: Since 2022, Russia has been excluded from the global transfer system SWIFT, which has made it harder to carry out financial transactions across borders.

Concerns about the weaponisation of the dollar has led some non-Western countries to pursue dedollarisation, or reducing their reliance on the US dollar, especially in trade.

Challenges to the Existing Currency Order

The rise of non-Western countries, both economically and geopolitically, has led to initiatives to reduce the dominance of the existing currency order.

Central banks have begun exploring the use of digital currencies (CBDC), which exist purely in electronic form and rely on online transfer systems.

By 2024, 111 countries, representing over 95% of the world economy, were actively exploring CBDCs.

Digital currencies becoming widely adopted in the future could make international payments and currency exchange easy, removing the need to use the US dollar.

Another way to limit the power of US dollar is to trade directly in the currencies of the trading countries, even by using cash.

However, trade imbalances and capital controls make it harder for countries to use their money in other markets.

In 2024, Russian exports to India exceeded $65 billion while India only exported $4.9 billion to Russia. As a result, Russia has accumulated billions of Indian rupees that it is having difficulties spending.

Members of BRICS have suggested the creation of a BRICS currency or a transfer system.

While nothing has been formally proposed, it could be a currency backed by the reserves of member states, or a non-SWIFT based financial transfer network.

Goal: shield the bloc from Western sanctions while boosting their own geopolitical significance.

However, there is currently no agreement on these issues, and reaching one could become harder if the group continues to grow.

There has been a rise in purchases of non-traditional reserve currencies, which are secure currencies that have traditionally not been used for investment or international trade.

These have become more popular as a way of diversifying risks associated with major currencies.

Some non-traditional currencies include the Norwegian crown, the Australian dollar, and the Chinese renminbi (yuan).

Gold remains a popular asset as a safety net against crises or sanctions.

Many countries have traditionally stored their gold abroad in countries like the US and the UK but growing geopolitical tensions have led encouraged governments to begin returning their gold home.

One of the biggest challenges the existing currency order faces is the rising public sector debts across developed economies.

A currency is more attractive for investment if the country issuing the currency is seen as being responsible with its finances.

The Euro

As part of its efforts at European integration, the EU launched a monetary union. This means creating a common currency, the euro.

Currently, 20 out of 27 EU member-states share the currency, making up the Eurozone.

Goal: to simplify trade within the bloc, boosting growth.

For countries that have adopted the euro, the currency remains popular among citizens.

Despite making trade easier, the euro has also created problems for the European Union as it linked economies with different characteristics.

Countries like Greece, Ireland and Portugal have experienced high levels of public debt while, for example, Germany has not.

Additionally, some countries are more export-dependent than others and would benefit from a currency devaluation but are unable to do so.

One eurozone member potentially defaulting on its debt (being unable to repay) creates risks for the bloc as a whole.

Fiscal policy — the government’s spending and taxation, and related matters.

The eurozone is a monetary union, but not a fiscal union.

This makes it harder for the bloc to redistribute money between members and respond to economic crises.

Within one country, taxes and benefits move money from wealthier citizens to lower-income households.

Within the EU, there is no strong mechanism to redirect money from wealthier to poorer countries.

Multipolar Currency Future

As the distribution of power continues to shift away from Western dominance, it is increasingly likely that the power of individual currencies will also change.

There may be a fragmentation of the existing currency system, resulting in the co-existence of several major currencies.

The role of the US dollar as the world’s reserve currency may decline and even end but is unlikely to be replaced by a single other currency.

The future of currencies will be determined by the trust and reliability of governments, geopolitical realignments, and the desire to diversify risks as multipolarity becomes the new norm in international relations.

Author Naman Habtom, PhD

Editor Anton Kutuzov