Trump’s Tariffs, revisited

Current status, and the effects so far

Published: January 8, 2026

Scroll to section 2 for Tariffs' Effects.

Why did Donald Trump set new import tariffs?

Bringing manufacturing to the US: encouraging local companies to produce more in the country.

Protecting local industries:encouraging consumers to buy more US-made goods by making them relatively cheaper.

Cutting the trade deficit: reducing the gap between what the US imports and what it exports.

Increasing state revenue: the US government earns money from higher import tariffs, especially short-term.

Diplomatic pressure: the US uses (the threat of) tariffs against its trade partners to get political favours.

What tariffs are in place?

First, a baseline 10% tariff was set on all goods from 180+ countries.

In addition, there are 2 types of tariffs: (1) on specific industries, and (2) on specific countries.

Industries

Trump imposed 50% tariffs on steel, aluminium and copper, and a 25% tariff on cars, to protect them from foreign competitors and stimulate production.

Industry support: US steel, aluminium and heavy machinery sectors favoured the tariffs, but carmakers opposed them due to losing revenues from higher costs of imported materials and parts.

Countries

The largest US trade partners initially faced tariffs above 10% (as high as 46%) but negotiated lower rates after agreeing to reduce trade barriers for US goods.

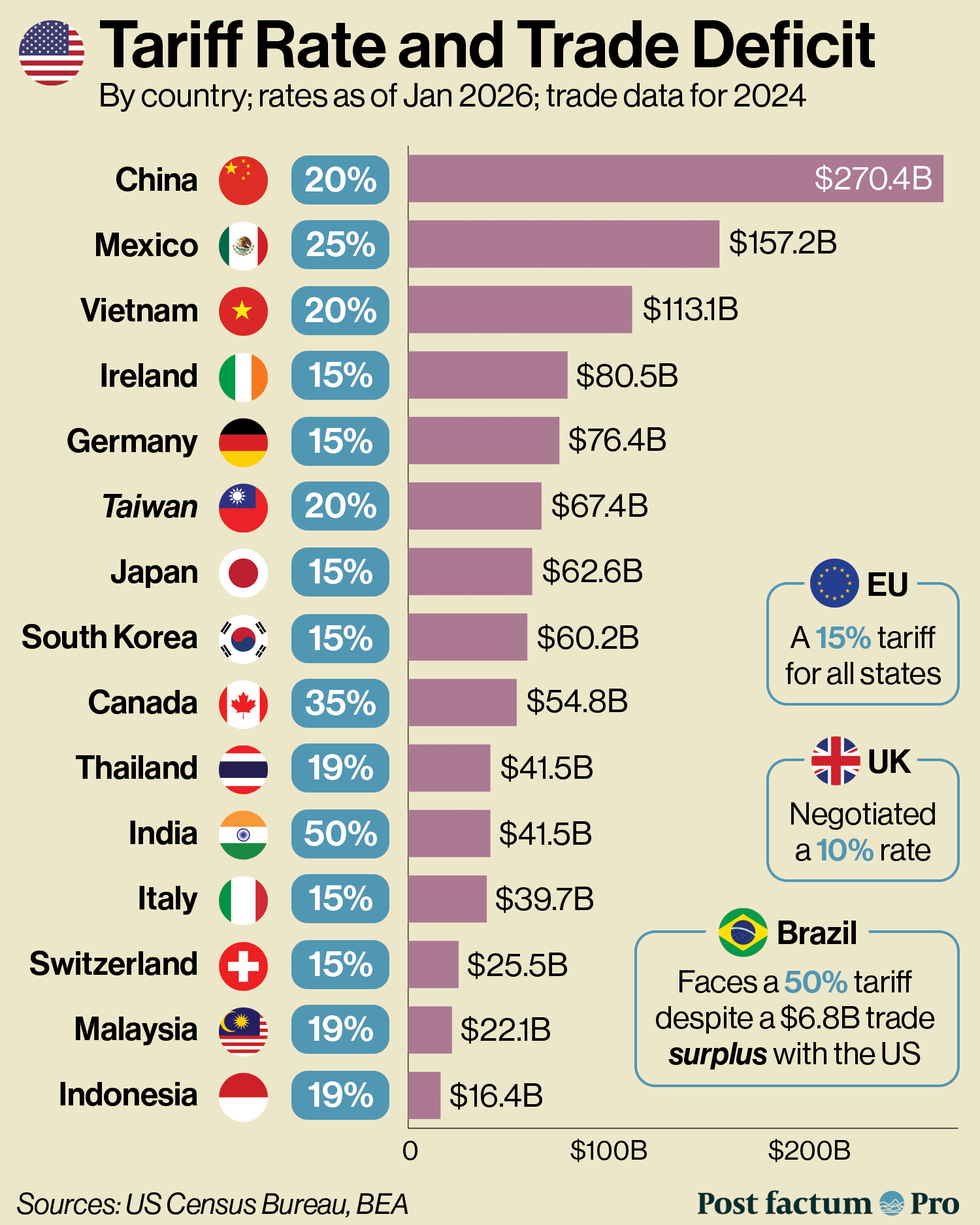

Current rates are 10% for the UK; 15% for the EU, Switzerland, South Korea and Japan; 20% for China, Vietnam and Taiwan, 25% for Mexico, 35% for Canada, and 50% for Brazil and India.

Transshipment tariff: an extra 40% is applied to goods shipped through other countries to avoid tariffs, especially Chinese goods shipped through Vietnam and Mexico.

The UK negotiated a 25% tariff rate on steel and 10% on cars, compared with 50% and 25% respectively for other countries.

In exchange, the UK allowed increased imports of US beef and ethanol.

Mexico and Canada faced a 25% tariff rate, with the US accusing both of failures to stop drug trafficking and illegal migration.

Canada’s rate was increased by another 10% after a Canadian politician sponsored an ad with an anti-tariff quote by Ronald Reagan: a former President from the Republican party (as is Donald Trump).

Around 38% of Canadian imports and 50% of Mexican imports were later made exempt, in line with a 2020 trade agreement.

India faces a 50% tariff, as the US pressures its ally for buying Russian oil and military equipment.

Brazil also faces a 50% tariff rate, linked to its support for BRICS, and the prosecution of the right-leaning former president Bolsonaro.

Additional tariffs were removed for somekey imports like iron, beef, coffee, tropical fruit, and wood pulp.

China

In March-May 2025, Trump raised the tariff rate for China from 20% to 145%, calling it the “worst offender” in global trade. Why?

China manages its currency: the yuan is undervalued, making Chinese exports comparatively cheaper.

Chinese companies get subsidies from the state, making them more competitive globally.

Concerns of “dumping”: selling goods abroad at extremely low prices, damaging local producers.

Non-tariff restrictions: China has laws and regulations preventing international firms from entering.

Potential damage to communities affected by competition from Chinese goods and firms.

China hit back by raising tariffs on US goods to 125%.

Apple started moving iPhone production from China to India to reduce costs, similarly to some other companies.

In May, the US and China reached a temporary deal:

The US cut the tariffs on China from 145% to 30%, and China cut its tariffs on the US from 125% to 10%.

Later, China introduced tougher export restrictions on rare earths, critical to some US industries.

China refines 90% of all rare earths, including all of the world’s samarium, a rare earth metal used for F-35 fighter jets and missiles.

After negotiations, China paused its rare earth export controls, and the US suspended some export restrictions on semiconductors, until November 2026.

Effects

Introduction of the 10% baseline in April triggered the biggest global single-day stock market drop since the COVID-19 crash in 2020.

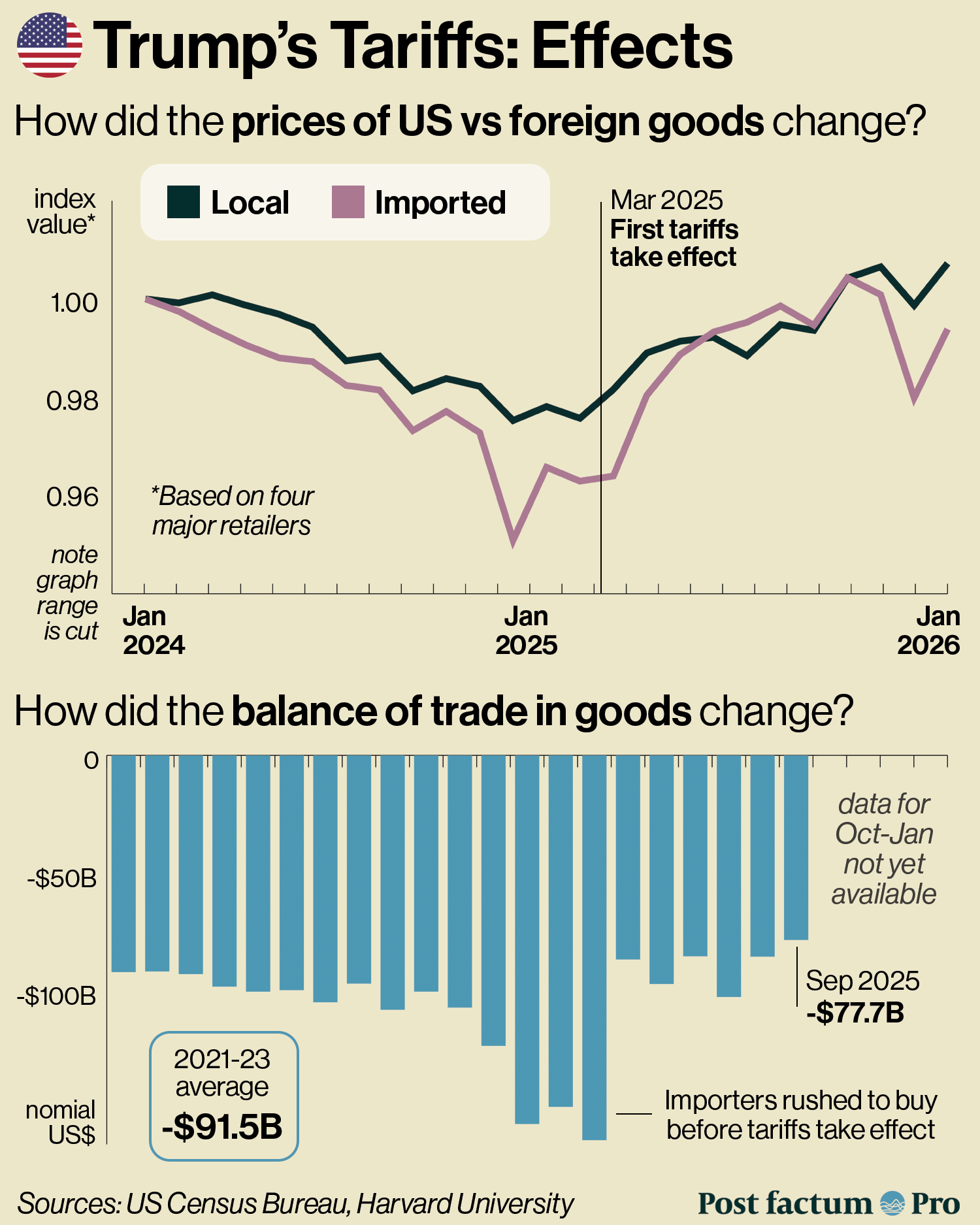

First, most of the tariff costs fell on the US importers (not foreign firms)who absorbed them by accepting lower profits instead of fully raising prices.

By October, US consumers also began to see the impact, with prices for imported goods rising by about 5% since March, compared to 2.5% for US-made goods.

In response, Trump cut tariffs on some foods like beef, coffee and fruits to lower or stabilise grocery prices for US consumers.

By December, the government had gathered over $200 billion in tariff revenue, which Trump proposed using for a range of things from paying off some national debt to giving out “tariff dividend” payments to Americans.

A US appeals court ruled most of Trump’s tariffs illegal, saying he exceeded his authority, but the tariffs remain in effect.

The case went to the Supreme Court, with the decision expected by early 2026.

If tariffs are declared illegal, the US government may have to refund importers.

Trump’s tariffs partly achieved their goals: the US trade deficit fell to a 5-year low, and some countries offered more favourable trade conditions to the US.

However, US consumers saw higher prices, and US firms faced growing costs of imported materials and supply chain disruptions.

The US manufacturing sector shrunk for 10 months in a row from March 2025.

The effect of the new tariffs has been smaller than expected: the real rates are lower than official policy suggests.

In September 2025, effective average tariff rate paid was 14%, compared to the average nominal official rate of 27%.

Thank you for reading!

Author Ostap Salovskyi

Editor Anton Kutuzov