Crude Oil Geopolitics

Remastered June 1, 2025

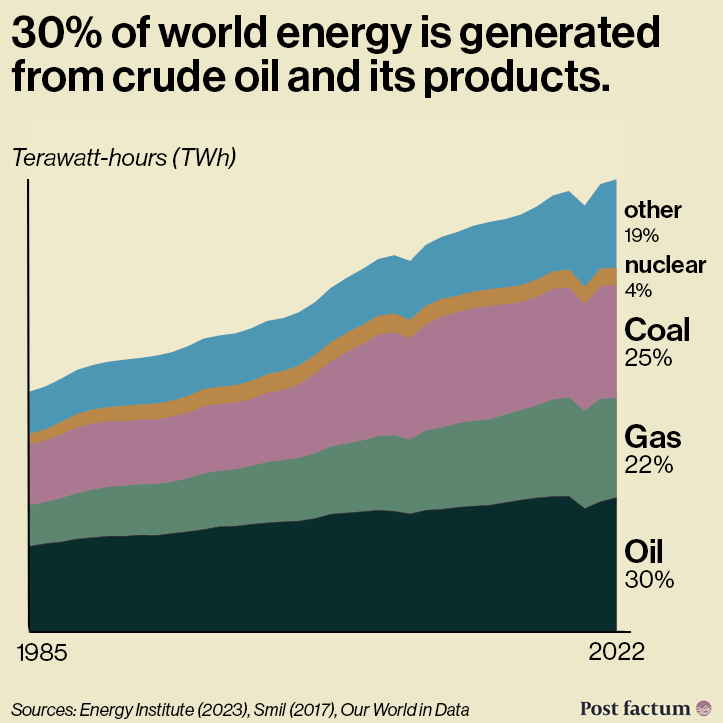

Almost a third of all the energy used by humans comes from oil.

Fuels for cars, planes and ships are made from crude oil (or petroleum).

Electricity is sometimes generated from burning oil products, and often from burning natural gas, which is extracted together with oil in many locations.

Oil is also used to make plastics, as well as fertilisers, cleaning products and medicines.

As a result, any economy relies on the availability of oil to grow.

Almost any business involves some form of transportation, often burning fuels made from oil.

This means that oil is a component of almost any product or service.

There are few substitutes for crude oil, as alternative plastics or biomass petroleum remain fringe technologies.

Changes in oil price, therefore, strongly affect all prices in the economy.

An increase in the price of crude oil reliably creates inflationary pressure (increases prices for products in general), as producers experience higher costs.

A decrease in price, however, does not reduce inflation reliably, as sellers tend to increase profits, not decrease prices, when production costs are falling.

Governments have better chances of reelection when fuel prices and inflation are low, particularly in the US.

Oil is a critical resource, because any economy is sensitive to a change in its price.

Buyers of oil try to prevent or cushion any price shocks.

Factories and industries buy futures contracts (obligations to buy later at a pre-agreed price), allowing them to know the costs in advance.

Governments are also increasingly concerned about securing supplies of oil.

What moves the price of oil?

At its core, oil price is created by demand and supply.

Higher global demand or lower global supply pushes the price up, the opposite is also true.

This basic economic law is especially true for commodities, like oil, gas, coal, grains or metals.

However, there are also different types of oil, and many other factors that affect prices locally.

In general, economic growth creates demand for oil and increases its price.

The increasing efforts to make the global economy less dependent on oil, like introducing nuclear and renewable energy, are slowly breaking down this link.

Where does global demand for oil come from?

Because oil products are central to almost any economic activity, the demand for oil correlates with the size of the country’s economy.

The United States is the biggest consumer of oil, closely followed by China.

When combined, European countries edge into second place, however.

Other major consumers include India, Russia, Japan, South Korea and Brazil.

Saudi Arabia is the fourth largest consumer of oil, but it mostly uses its local oil, which is extracted and delivered cheaply.

Any changes in economic performance of these major players have a significant impact on prices.

For example, oil prices grew quickly as China experienced faster-than-expected economic recovery from the pandemic.

Want more of Post factum?

We have just launched News Breakdown, our second newsletter!

Focus: Analysing media angles on major events to expose bias and manipulation.

Check out a free edition - Venezuela: Maduro's third re-election.

Where does the supply of oil come from?

The supply of oil firstly depends on oil reserves available for extraction at a reasonable cost.

Largest producers of crude oil are the United States, Saudi Arabia and Russia.

Historically, they have always been the three major suppliers of oil, surpassing each other for the top spot.

Can oil reserves run out? Currently known reserves are estimated to be gone in 47 years, but new ones become available as extraction technology improves and becomes cheaper.

Market sentiment

Oil is a heavily traded commodity, meaning many traders buy contracts for oil delivery only to sell them, not to receive the oil themselves.

Because of this, market opinion on where the price will go is quickly reflected in the real price.

For example, if China reports higher than expected economic growth, the price of oil is likely to jump up when this information comes out, because traders predict a higher demand from China coming up.

There are different types of oil, especially based on their “sweetness” (sulphur content) and “gravity” (density), but also total acidity level.

Sweet and light oil with low acidity is preferred, although some processes may require different types.

Malaysia is known to extract highest quality crude, while Brent and WTI oil types produced in the US are higher quality than the “sourer” oil from the Middle East.

Additionally, oil has to be shipped (transported), normally by sea tankers or through a pipeline, so limits to capacity to transport oil or disruptions to trade routes are important price factors.

A complex power struggle between buyers and sellers determines the oil market.

Suppliers can slow down the production of oil or invest in its expansion to affect prices or counteract changes in demand.

Oil-producing countries use this power to project influence globally.

Since 1960, we have OPEC (Organisation of the Petroleum Exporting Countries).

OPEC acts as a partnership of oil suppliers aiming to coordinate how much they produce to keep the oil price where they need it (in economic terms, they are a cartel).

OPEC is led by Saudi Arabia and currently has 12 member-states, but a number of other major producers (known as OPEC+) have often supported OPEC strategy to varying extent.

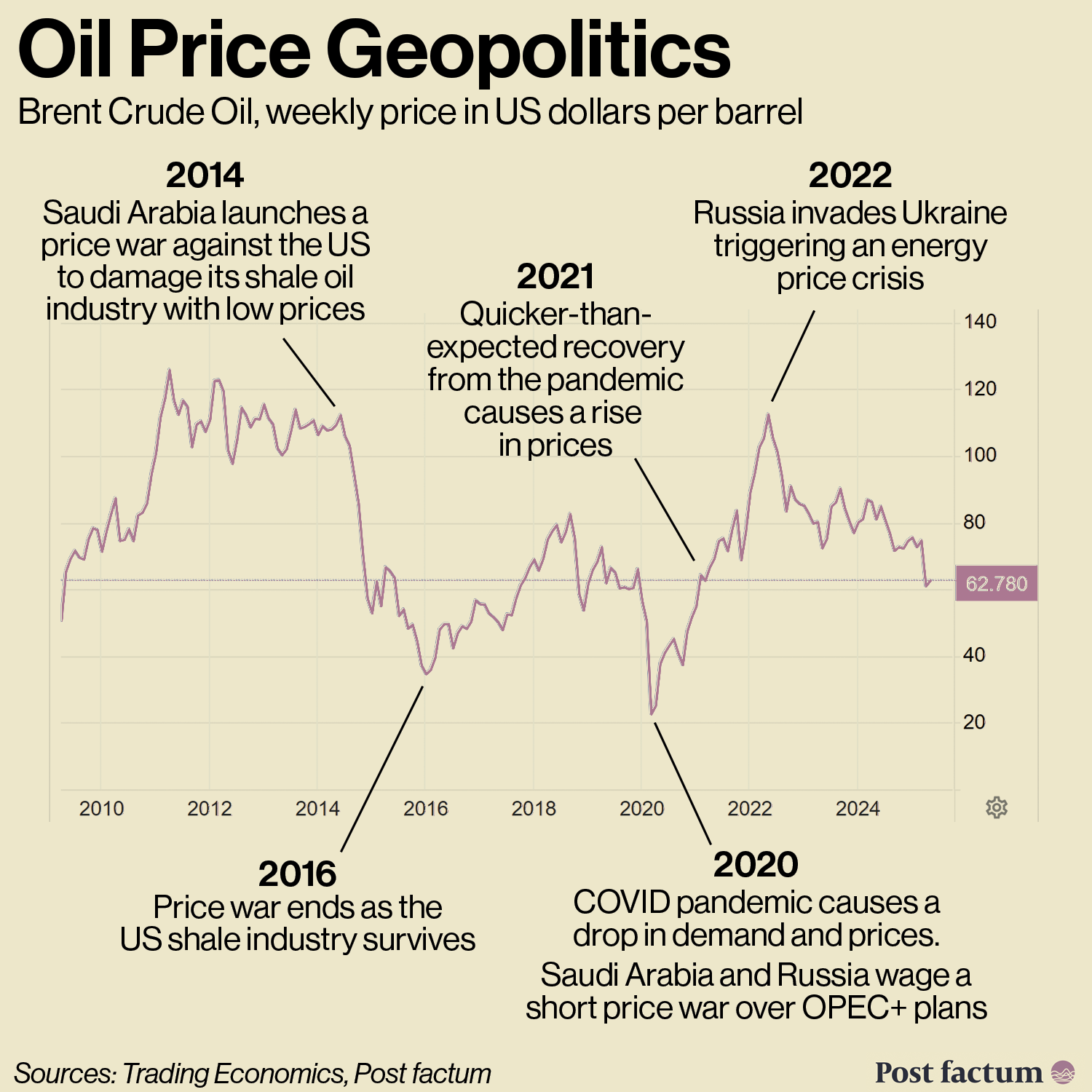

In recent years, OPEC has launched a number of “price wars”: trying to sharply change the global oil prices by over- or under-producing.

In 2014-16, Saudi Arabia and OPEC increased production, causing a fall in price. They were trying to stop the growth of US oil and gas industry, which needed higher prices to be profitable.

In 2022, OPEC accounted for 36.2% of global oil production.

Largest buyers of oil can also potentially pressure suppliers into lowering prices (if they do not have alternative clients) which was especially true in the early years of oil trade.

How to Think About Oil Geopolitics?

Shale energy

Shale is a type of layered rock that often holds a lot of crude oil and natural gas.

Since early 2000s, advances in two technologies, horizontal drilling and hydraulic fracturing, allowed to increase the efficiency and output of shale oil and shale gas industries.

The United States is the main proponent of shale energy, expanding these sectors significantly since 2008 to when they now account for about half of country’s oil and gas production and contribute to oil self-sufficiency.

One advantages of shale extraction is that it can be paused and restarted at any time, unlike regular oil extraction.

Cost of production

Depending on the location and the type of the oil, as well as technological and industrial specifics, some countries can produce oil much cheaper.

Best available data suggests that Saudi Arabia production costs are around $5-10 per barrel, Russia’s — $15-20, while in the US the costs are around $35 per barrel.

At certain prices some oil producers can profit and others can struggle.

Breakeven price

This refers to a specific price at which a (country’s) budget is balanced, meaning it spends what it earns and does not need loans.

Some countries rely on oil exports for a large part of their revenue and need to sell their oil at a certain price to get enough of it. This is the breakeven price of their budget.

For example, Saudi Arabia enjoys an extremely low cost of producing oil, but they must sell it at a higher price, or they will not earn enough to cover their spending commitments.

Currency reserves

This refers to the foreign currency (especially the US dollar) held by a country.

Having enough currency reserves is important, because foreign currency is used to buy imported goods.

If the local currency becomes too cheap, its price (exchange rate) can be boosted by spending foreign currency reserves on buying the local currency.

Saudi Arabia used its currency reserves to balance its budget while waging price wars.

Hedging profits

Hedging is a strategy when one investment is balanced with its opposite, so that you do not lose as much in case the original position does not work out.

For crude oil, when producers enjoy high oil prices, they can hedge their risk by betting on oil prices to fall, therefore standing to gain profit either way.

This is particularly important for long-term investment planning into expanding production, as having hedged future profits provides security.

Self-sufficiency

Ideally, countries would prefer to buy their oil at the cheapest prices from the best producer.

In reality, when the producer gains too much power over the buyers, it can use this dependency to increase prices and punish the buyers.

Because of this, countries want to achieve self-sufficiency in oil, or independence from imports.

For example, the United States increased domestic production by expanding shale oil sector and are now capable of meeting their own demand, making it immune to suppliers’ attacks like OPEC price wars.

In contrast, European countries produced energy from imported oil and gas, especially from Russia.

Cutting off trade with Russia after its invasion of Ukraine increased the prices of energy and required finding new suppliers, costing the EU over $300bn in energy subsidies alone.

Refining

Crude oil must be refined before it can be used as fuel or material for plastics, synthetics and other products:

Refininginvolves complex industrial processes and expensive infrastructure, and is effectively distillation of the crude oil.

Many oil-producing countries do not refine all their oil and instead export it raw, then importing the products made from it.

True self-sufficiency requires enough of both production and refining capacity.

Importantly, China (which consumes lots of oil without producing much) has a vast refining capacity.

Being a major player in refining helps China counteract its dependency on exporters of crude oil with their own demand for refined oil and its products.

Author Anton Kutuzov

Sources and further reading

The data presented is largely sourced from:

International events and market analysis based primarily on:

You can help us secure our long-term future!

Please consider sending us a regular donation.

Find out more: